Considering the prospects of reduced fuel costs, increased fuel economy and overall lower operating costs, the conversion of America’s millions of big rigs from diesel to natural gas would seem obvious. According to industry experts convening at this year’s American Trucking Association’s (ATA) Natural Gas in Trucking Summit, the time to turn this vision into reality is long overdue. The industry is willing, the technology is available, and U.S. natural gas resources abound. Two primary hurdles must be overcome in order to fuel the transition.

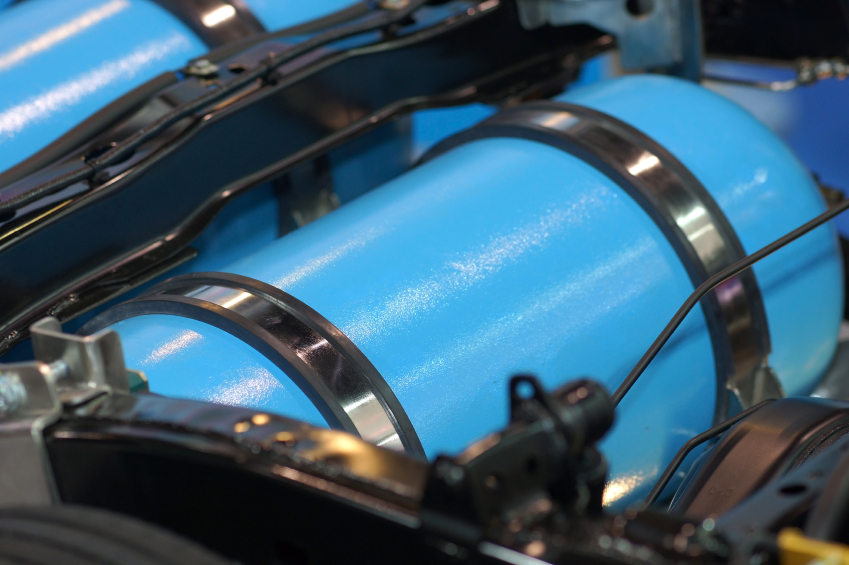

Currently, the cost of natural gas is only about two-thirds the cost of an equivalent amount of diesel fuel. Trucks made to burn natural gas, however, are more expensive to buy. The additional expense is related to the requirement for modified engines and the installation of larger, stronger fuel tanks. CNG, or compressed natural gas, is used primarily for fueling cars, smaller trucks and buses. LNG, or liquefied natural gas, is used by larger, 18-wheel semi trucks. Both require specialized on-board tanks for fuel containment.

The cost of manufacturing semi-tractors that burn LNG is expected to diminish as more companies become involved in their production. Currently, there are few options available, with Cummins leading the field, but an additional three manufacturers are expected to bring out new natural gas burning engines in 2013.

The second hurdle to implementation of LNG use in the trucking industry is lack of an adequate fuel delivery infrastructure. Clean Energy Fuels Corp. currently has approximately 75 LNG stations nationwide, with that number expected to double in the near future. Shell Oil is also seriously involved with natural gas, with 2012 marking the first year their natural gas production has eclipsed their development of oil resources.

The Drive To Transition

Trucking industry news coming out of the Natural Gas Summit is positive regarding the role of natural gas and its great potential. While some fleets have begun experimenting with this alternative, equipment options have been few and a broader network of filling stations is needed. In areas where refueling facilities are operational, companies such as Walmart and UPS have been running natural gas-burning rigs, realizing fuel cost savings in the 25 percent range.

Several new CNG dispensing stations are slated for construction in the Denver area, but LNG facilities are needed to provide fuel for area trucking companies considering the transition to this cleaner, more economical and environmentally friendly technology. We hope to buy a natural gas truck in 2013 and hope the industry as a whole will follow.